Those of you that know me well, know that I am HORRIBLE at math! But, give me a calculator & a balance sheet, profit or loss, receipts, etc… & I can break it down like no other!!

So “please” believe me, when I say… “buying instead of renting” is ALWAYS the way to go! & here’s why!

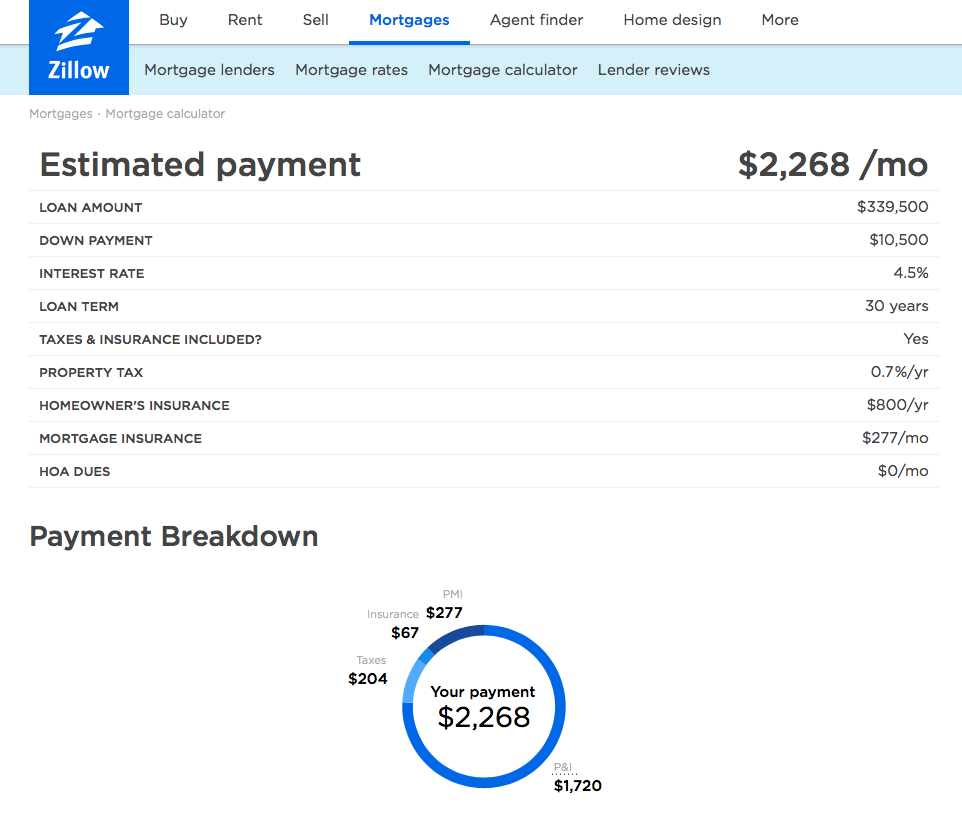

- Let’s just hypothetically assume that you purchased a $350k home with 3% down, a 4.5% interest rate & a 12% appreciation rate.

(That’s a loan amount of $339,500 with a payment at about $2300/mo = $27,600/yr & $42k in appreciation in a year)** click photo or follow link to play with some numbers **

https://www.zillow.com/mortgage-calculator/

- Average rent for a 2 bedroom apartment in Seattle is roughly $2000/month according to Rent Jungle. (That’s $24k in one year!!!)

So, if you did the math in this scenario, you’d only be paying roughly $3,600 more for a mortgage compared to rent in a year. BUT, if you factor the “annual appreciation,” you’d technically be putting $38,400 in YOUR POCKET and “not your landlord’s pocket.”

Were you told that you need 20% for a down payment or good credit??? What if I told you that you don’t need 20% down and it’s easier than you think to build up your credit???…

Well it is possible!! Connect with a mortgage loan officer to learn more! Need a few references to a great loan officer? Give me a call. I’m always happy to HELP answer questions & look for answers!!

Thanks for reading!! …until next time!